Public Adjuster Fundamentals Explained

Table of ContentsIndicators on Loss Adjuster You Need To KnowThe Best Guide To Loss AdjusterTop Guidelines Of Public AdjusterSome Known Incorrect Statements About Public Adjuster Property Damage for DummiesThe Best Strategy To Use For Property Damage

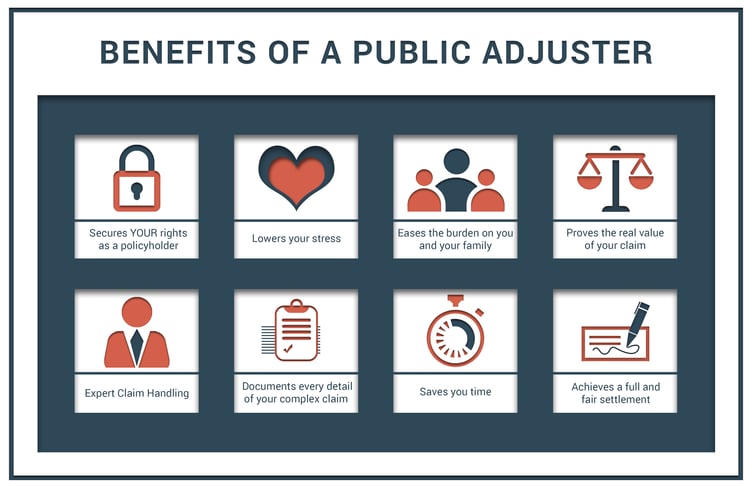

If you desire to see to it that you obtain all the advantages supplied by your insurance policy and the largest negotiation possible, it's worth speaking to a public insurance coverage insurer today! They are professionals that work to get you the most effective negotiation feasible from your insurance provider. They can assist determine what is and also isn't covered by your policy, and also they will certainly take care of any type of disagreements or settlements on your behalf.There are distinct sorts of insurance coverage claim insurers: The policyholders themselves and not the insurance company work with public insurance adjusters. Outdoors adjuster gotten by the insurer. Typically from huge companies who consent to the insurer's pre-set procedures. Personnel insurers are worked with by the insurance policy company. They are either outside professionals or more frequently function within the firm itself (property damage).

Out of all the classes of insurance case insurance adjusters, public adjusters are the only ones that are independent of insurance policy business. They are hired by the policyholder to discuss the claim as well as to make sure that they receive the right amount of money. The objective is to obtain the insurance coverage firm to cover the entire damage or loss to their buildings or building from a disaster or mishap.

About Public Adjuster

They were placed right into location to guarantee that insurer would pay all claims from clients and not attempt to minimize expenses by underpaying for a claim or refuting it completely. The general public adjuster's job is easy: they evaluate your policy, identify what you are owed, and afterwards combat in your place to get the complete negotiation.

If you have a mortgage, the lien owner likewise will be a payee, as will certainly any other events with insurable passions. A public adjuster acts as your agent to the insurance provider. Their objective is to browse all stages of the claim process and also advocate for the very best rate of interests of the insured.

3 Easy Facts About Property Damage Described

This permits the insured to focus on other, more vital tasks rather than handling the stress and anxiety of insurance coverage settlements. This is especially valuable in the days and weeks following a loss. There are many various duties that public insurers execute for the insurance policy holder: Determine Coverage: Assess as well as analyze the insurance coverage as well as establish what protection as well as limits apply.

Some insurance coverage adjusters have much more experience as well as will certainly do a much better task. It's always practical to request referrals or to see a list of to gauge the insurer's capacity. Not all insurance coverage asserts follow a set course. There are always differences as well as concerns that need to be browsed. A proficient insurer requires to prove three points: Loss conditions fulfill the standards for insurance coverage.

Some Known Incorrect Statements About Public Adjuster

That the negotiation amount will totally recover the policyholder's property to pre-loss condition. Any kind of tip that verifying these things is simple, or that a computer system can do it for you, just isn't true. Cases really quickly come to be a tangled mess due to the fact that the: Loss problems are not clearly stated, not effectively evaluated and documented, or they consist of several causes or a number of plans.

The discussing process starts as quickly as you incur a loss. In the occasion of a loss, it is very important to be prepared and have all your paperwork handy. If the loss is significant, you may want to get to out to a public insurance insurer initially. But you should alert your insurance coverage firm asap.

Realize that they will be reviewing just how much you understand about your plan limits, the problems you have actually received as well as if you are aiming to an agent, public insurance adjuster or insurance coverage provider for recommendations. A public insurance adjuster breaks the evaluation cycle, actioning in as your exclusive professional agent. With an equal opportunity, great deals of documentation, and iron-clad proof of all appraisals, it is challenging for the insurance provider visite site to say for anything much less than a full and also fair negotiation.

The smart Trick of Loss Adjuster That Nobody is Talking About

The chart listed below shows some of the more small insurance claims that we have actually helped to resolve. As you can see in every circumstances we gained our customers at least double the amount of the initial insurance policy business deal. public adjuster.

Keep in mind that there is a great deal at risk, and also the insurer has lots of experience in controlling outcomes. It's simple for emotions to run hot, particularly when you're the one with everything to shed. If generated early, a qualified public insurer can end up being the equalizer for you. When conflicts occur, your public insurance adjuster will certainly know what to do and also function to resolve the trouble efficiently.

If the loss is significant, you may desire to get to out to a public insurance coverage insurer. You must alert your insurance coverage company as quickly as possible.

About Public Adjuster

All we can do is share what we have won for clients. The chart listed below reveals some of the extra modest cases that we've assisted to settle. As you can see in every circumstances we made our clients at the very least dual the amount of the initial insurance coverage business offer. This Chart of Current Healings reveals just a few of the settlements that we have actually helped to win.

Bear in mind that there is a great deal at stake, as well as the insurance provider has lots of experience in regulating outcomes. It's very easy for emotions to run warm, especially when you're the one with every little thing to shed. If generated early, a qualified public adjuster can come to be the equalizer for you. When disputes develop, your public adjuster will certainly know what to do as well as function to deal with the problem successfully.